It’s no surprise asset managers looking to broaden investment strategies and meet customer demand are increasingly focusing on exchange-traded funds (ETFs).

In the past five years alone, ETF assets have nearly doubled, reaching $8.12 trillion in 2023¹, and are poised to make up 28% of total fund assets by 2027.² Currently, more than 8,000 ETF funds exist — up from only 1,500 in 2013.³

Interested asset managers are quickly learning that launching an ETF involves nuances in operations and distribution that they may not prepared to manage with existing resources. This is why, even as the market for ETFs burgeons, managers are choosing to partner with firms who demonstrate expertise delivering technology-powered efficiency to streamline the process.

THE OPPORTUNITY IN ETFs

ETFs give asset managers the opportunity to expand the reach of their investment strategies to new markets and invest with greater flexibility than traditional mutual funds. Long known for their ability to provide investors with diversified exposure to various asset classes in a cost-effective and transparent manner, ETFs continue to be positioned for massive growth as investors become increasingly fee sensitive.

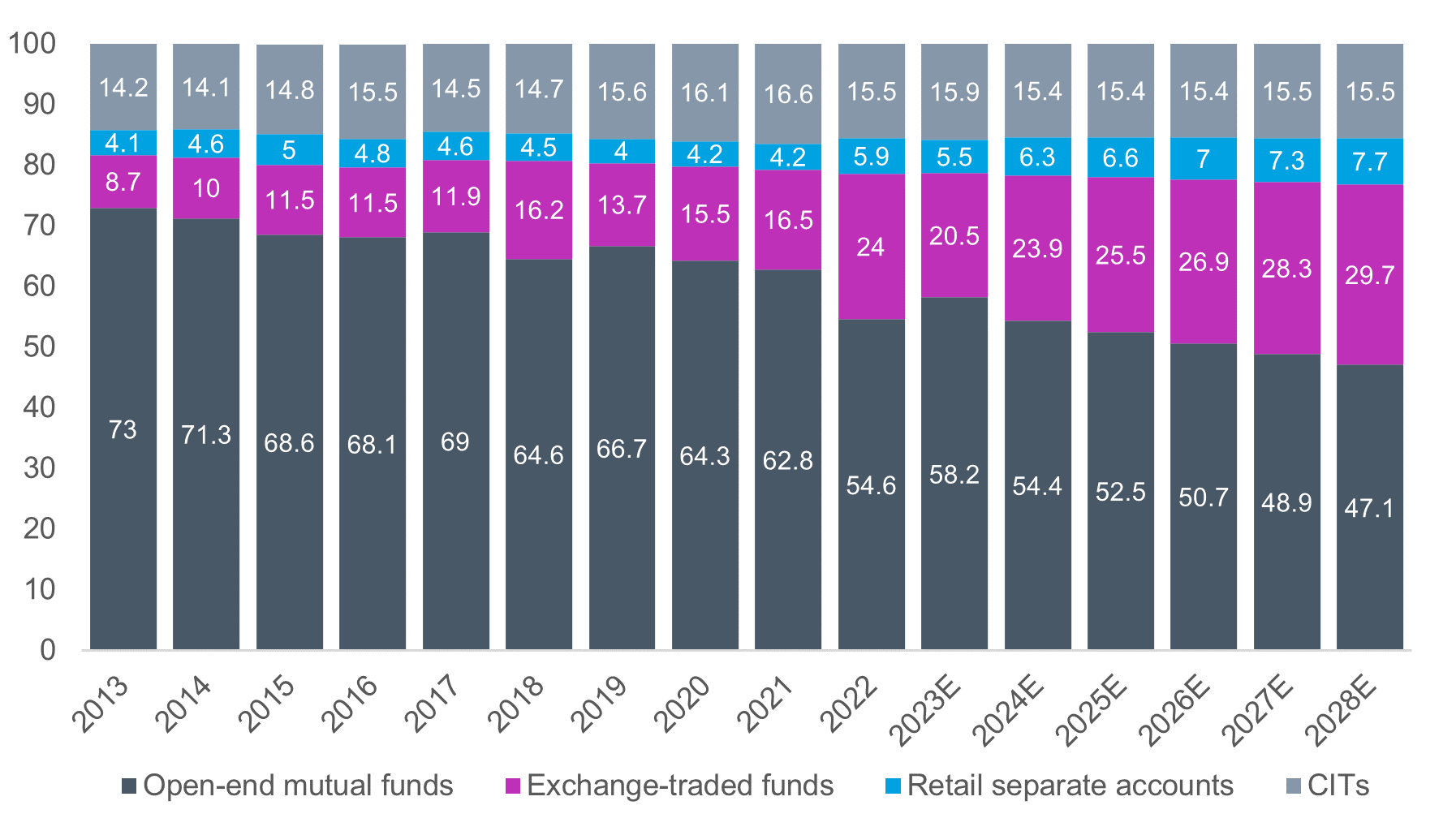

% MARKETSHARE OF RETAIL AND RETIREMENT VEHICLES 2013-2028E

In recent years, a notable surge in both active and passive strategies reflects the evolving preferences and demands of investors. Active ETFs, managed by investment professionals who actively select securities with the aim of outperforming the market, have gained traction as investors seek opportunities for alpha generation and tailored portfolio management. Passive ETFs, which track specific market indices and aim to replicate their performance, continue to attract investors seeking cost-effective and diversified exposure to various asset classes.

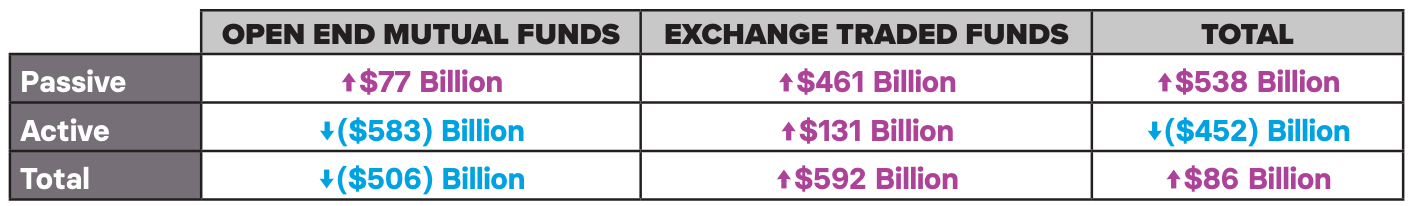

Passive ETFs continue to bring in the most inflows ($461B in 2023), but active ETFs are beginning to catch up, accounting for 22% of ETF flows in 2023.4 During this time, mutual funds saw $506B in outflows, indicating that ETFs are emerging as a clear leader as investors prioritize a diverse range of options, allowing them to align their investment objectives with the most suitable strategies. With this in mind, asset managers are preparing to scale their offerings to meet demand for ETFs.

OPEN-END MFs AND ETFs AUM BY INVESTMENT METHODOLOGY & PRODUCT STRUCTURE 5

CONSIDERATIONS FOR MANAGERS LAUNCHING ETFs

Because the opportunity is significant, prudent asset managers are thoroughly researching the distinctive features of ETFs to ensure they are positioned for success, including distinct operational and distribution elements. We’ve recently walked through the below considerations with several of our clients:

OPERATIONAL CONSIDERATIONS

- Know the impact of industry partnerships: Because ETFs are traded on exchanges throughout the day, it is important that asset managers establish partnerships with brokerage platforms and market makers to facilitate liquidity and efficient trading of their funds.

- Gain an understanding of the creation and redemption process: Managers that are new to ETFs should understand how new shares are created (by authorized participants) and redeemed (by investors). Baskets are used in ETF operations to facilitate th

e creation and redemption process, where a set group of underlying assets is exchanged for ETF shares, ensuring the fund's price closely tracks its net asset value. This mechanism allows institutional investors to trade large quantities of ETF shares efficiently.

e creation and redemption process, where a set group of underlying assets is exchanged for ETF shares, ensuring the fund's price closely tracks its net asset value. This mechanism allows institutional investors to trade large quantities of ETF shares efficiently. - Have a plan for managing restrictions: Managers must ensure compliance with guidelines set by regulatory bodies like the SEC, which govern aspects such as portfolio transparency and leverage limits. Additionally, asset managers should understand the liquidity of the underlying assets to effectively manage creation and redemption processes without significantly impacting market prices.

- Ensure accurate tracking of benchmarks: Accurate tracking of an ETF's benchmark is essential for maintaining its performance and delivering the expected exposure to investors. Asset managers must stay informed about changes to the index's composition, such as additions, deletions, or adjustments in weightings, and have a reliable method for updating the ETF accordingly. Transparency and timely access to index changes are critical to ensure the ETF continues to accurately reflect its benchmark.

DISTRIBUTION CONSIDERATIONS

- Consider a holistic approach: In the past, many asset managers may have been hesitant to launch ETFs alongside mutual funds or SMAs with similar strategies, for fear that ETF success would cut into their mutual fund sales. Today, managers are taking a more holistic approach, finding ways to launch ETF products that complement their mutual fund offerings, rather than compete with them, whether it be leveraging slightly different approaches to positioning the strategy or incorporating ETFs into other investment vehicles. Regardless, it’s important to stay realistic and recognize that while launching an ETF may cut into mutual fund revenue in the short term, offering both will ultimately create more opportunity for the business.

- Consider your data: Tracking sales of ETFs trading on the public market can be more difficult than what managers have come to expect from mutual funds. There are some options for capturing this data, but it can be expensive to gain information that provides real investor insights.

- Align your goals: One example of this is incorporating ETFs into SMAs. ETFs typically have low expense ratios and provide transparent, intraday pricing, which aligns with the goals of many SMAs to minimize costs and maintain liquidity. And because ETFs offer flexibility in implementing investment strategies, asset managers can swiftly adjust portfolio allocations in response to market conditions or client preferences. Integrating ETFs into SMAs can enhance portfolio efficiency and offer clients a cost-effective and transparent investment solution.

A STRATEGY FOR ETF SUCCESS

Clearly, the appetite for ETFs exists, making it a priority for asset managers looking to reach new markets. Asset managers who are new to ETFs can benefit from working with industry partners who have expertise in operations and/or distribution.

Without deep knowledge related to ETF management in these areas, asset managers can risk noncompliance, operational headaches, and product failure.

Service partners like Archer can bring operational expertise to the table to ensure scalable offerings and connectivity across the industry. Archer streamlines the process of deploying your investment strategy as an ETF, with connectivity that allows investment management firms to follow their own trading rules, interact with preferred brokers, and maintain their best execution process.

Get Started with Archer

Ready to accelerate your growth? Speak to a member of our business development team to see how Archer can help you hit your targets — faster.

Contact Us